Financial Strategy

I have explained about the financing strategy for a business plan in my last post. In this post, we'll know how to make financial strategy step by step.

Financing is one of the crucial matter in a business as it's main focus is to maximize the shareholder's fund. To satisfy this objective a company requires a long term course of action.

If we follow the older concept it mainly focuses on profit maximization but after modernization, this concept changed to wealth maximization. Wealth maximization refers to giving higher returns to the shareholders who are one of the major sources of finance for a company.

Coming to the financial strategy it is as follows:

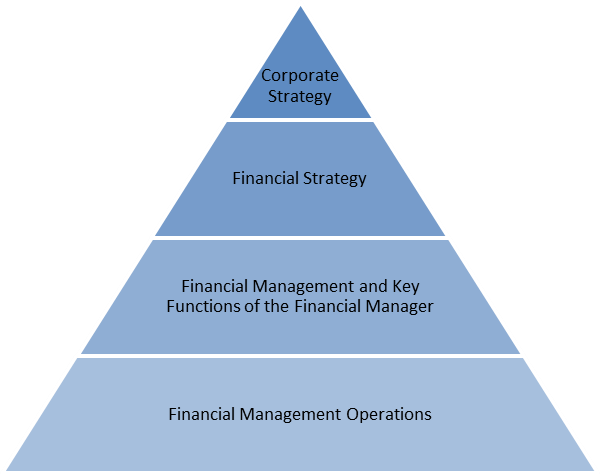

Starting at the tip of the pyramid, the corporate strategy is the first thing that a company must define to implement a successful financial scheme. It must consist of an overall, long term plan of action that comprises a portfolio of functional strategies (finance, marketing etc.) designed to meet the specified objective.

Financial strategy is the following important element upon implementing the plan. It is the portfolio constituent of the corporate strategic plan that embraces the optimum investment and financing decisions required to attain an overall specified objective.

Financial Management is concerned with the acquisition, financing and management of assets. It is the process of managing the financial resources of the company. It also includes accounting and financial reporting, budgeting, collecting accounts receivable, risk management, and insurance for a business, in alignment with the set financial strategy.

Financing is one of the crucial matter in a business as it's main focus is to maximize the shareholder's fund. To satisfy this objective a company requires a long term course of action.

If we follow the older concept it mainly focuses on profit maximization but after modernization, this concept changed to wealth maximization. Wealth maximization refers to giving higher returns to the shareholders who are one of the major sources of finance for a company.

Coming to the financial strategy it is as follows:

|

| Financial Strategy |

Starting at the tip of the pyramid, the corporate strategy is the first thing that a company must define to implement a successful financial scheme. It must consist of an overall, long term plan of action that comprises a portfolio of functional strategies (finance, marketing etc.) designed to meet the specified objective.

Financial strategy is the following important element upon implementing the plan. It is the portfolio constituent of the corporate strategic plan that embraces the optimum investment and financing decisions required to attain an overall specified objective.

Financial Management is concerned with the acquisition, financing and management of assets. It is the process of managing the financial resources of the company. It also includes accounting and financial reporting, budgeting, collecting accounts receivable, risk management, and insurance for a business, in alignment with the set financial strategy.

Financial Management for Strategy Formation

Financial Management is concerned with the acquisition, financing and management of assets. It is the process of managing the financial resources of the company. It also includes accounting and financial reporting, budgeting, collecting accounts receivable, risk management, and insurance for a business, in alignment with the set financial strategy.

In brief, it consists of the use of financial information, skills, and methods to make the best use of an organization's resources. A well-developed financial strategy can help the businessman to:

- Effectively manage the company’s assets.

- Invest wisely

- Support operations

- Provide means for future growth

- Make decisions on how best to finance the company.

- Meet the needs of customers & employees

- Compensate shareholders for their risk

To meet the corporate strategy objective, the financial director is responsible for covering a wide array of functions. The financial management operations that the manager must supervise include:

- Raising sufficient capital for the assets needed by your business

- Earning adequate profit consistently and predictably

- Managing cash flow from profit

- Minimizing threats of fraud and other losses

- Minimizing the income tax burden on your business and its owners

- Forecasting the cash needs of your business

- Keeping your financial condition in good shape and out of trouble

- Putting a value on your business when the time comes

Key functions of Financial Manager:

- Estimating the Amount of Capital Required

- Purchase of fixed assets

- Meeting working capital requirement

- Modernisation of Business

- Expansion of Business

- Determining Capital Structure

- Mix of equity & debt

- Long term & Short term debt

- Minimum cost of Capital

- Maximise shareholders wealth

- Choice of sources of fund

- Equity shares

- Preference shares

- Debentures & bonds

- Banks loan

- Public Deposits

- Procurement of funds

- Creditors

- Financial institutions

- Issue of prospectus

- Utilization of Funds

- Investment decisions

- Safety

- Profitability

- Liquidity

- Disposal of profits & surplus

- Retained earnings

- Dividend distribution

- Management of cash

- For wages

- Day to day expenses

- Liquidity of the firm

- Financial Control

- Ratio Analysis

- Return on investment

- Break-even Analysis

- Internal audit

This is how Financial Strategies in Corporates are prepared & the key functions that a finance manager plays in it. If you want to learn more of the concepts of finance you can follow this blog & do check other posts.

Seeing forward to get your valuable feedbacks. How you feel about this blog.

Happy Learning!!!

Good work

ReplyDeleteThanks a lot!!

DeleteThis comment has been removed by the author.

ReplyDeleteVery informative

ReplyDeleteNice blog...all posts are great to learn new things...seeing forwrd to read more posts from you.

ReplyDeleteVery Informative, data is complete and useful.

ReplyDeleteThank you

Very well written...

ReplyDeleteI was looking for something like this for getting into the finance field. Would be waiting for something more to learn. Great work Finance Chhatra

ReplyDeleteVery good

ReplyDeleteInformative and helpful

ReplyDeleteVery informative article..good work Keep it up 👍👍

ReplyDelete